In less than a year, the UK will officially exit the EU. Here is an overview of the Brexit effect on the UK property market.

Recently, popular actor Sir Patrick Stewart joined Members of Parliament and business leaders in London for the launch of a campaign called The People’s Vote. The campaign calls for a second Brexit vote, and drew some 1,200 people, including representatives from all of Britain’s major parties.

The actor, who played Professor X in X-Men, and Captain Jean-Luc Picard in Star Trek: The Next Generation, had earlier said that both his iconic X-Men and Star Trek characters would have backed Remain. This provoked a retort from Boris Johnson, the British Foreign Secretary. Mr Johnson drew upon Star Trek’s famous line, saying that Brexit will enable the UK to “boldly go” to areas it has neglected in recent years as it seeks trade deals.

On 29 March 2019, the UK will cease to be part of the EU as per the terms of Article 50. Taking into consideration the time needed for ratification by both the EU and UK, negotiations need to be complete by the end of 2018, or both parties risk a ‘cliff edge’ scenario where ties are suddenly severed with no arrangement as to how to move forward outside World Trade Organization (WTO) rules.

Brexit and the property landscape

The UK has long been a global superpower with London as the world’s financial, education and cultural centre, even before it became a member of the EU.

Our position has always been that there will, undeniably, be risks and opportunities. And while uncertainty is bound to rock the housing and economic market, we are positive that the UK will adapt to changes caused by Brexit. The slowdown in the housing market is likely a short-term one as the lack of housing supply in the UK will not change overnight, thus there will continue to be opportunities for property investors.

CBRE, in its Brexit Guide for Real Estate Decision Makers released last month (March 2018), echoes the sentiment and concludes that Brexit is not likely to have a significant impact on the property market.

The British Prime Minister has said on many occasions that she would rather that no deal be made (in negotiations with the EU), than a bad one. CBRE calculates the probability of a no-deal Brexit scenario at around 25%. A no-deal scenario would mean the UK leaving on WTO rules, rather than continued preferential market access. Such an outcome could be damaging for the short-term confidence in the UK economy, especially if the UK is not well prepared.

What is significant for the real estate market are the current negotiations on future trade and migration arrangements.

Migration controls are likely to be tighter, but it is not clear yet to what extent the controls will be. In the 2017 General Election, the Government restated its target to cut nett migration to below 100,000 people per year. This will be challenging given that nett migration into the UK is currently more than double that amount, and added on to the fact that the Government wants to allow highly-skilled EU immigrants to continue to come to the UK.

The reduction in immigrants could very well cause labour shortages and inflation. A shortage in labour affecting the construction sector could mean the slowing down of on-going developments, inevitably causing real estate demand to rise. This was implicitly recognized in the Government’s November 2017 Budget, in which £34 mil was allocated to retraining the unemployed to work in this sector.

However, any attempt to tighten migration controls will not be made until 2021 at the earliest, given that the Government has made a commitment to import the entire body of EU law into domestic legislation, which will take a while.

This will also mean that regulatory legislation for the property market is likely to stay stagnant until after 2021 as well. Tax change is not likely to differ either. Most taxes have been nationally-determined, with the exception of VAT and customs duties where the EU has specific influence. Thus Brexit will not induce much change in that regard.

Residential Property

The residential property market is on the road to recovery, going up by 34% from the post-crisis sales rate, which was about 1.2 million sales in 2017.

First-time buyers have increased from the long-term average of 41% to 48%. This can possibly be attributed to the Government’s Help to Buy program, which provides more accessible financing for those looking to purchase residential property. Movers are hindered by a lack of stock coming onto the market, and this trend is most pronounced in London.

CBRE predicts that house price growth will slow to around 1.5% in 2018, but rally in 2019 and reach 17.1% in the next five years.

Commercial Student Accommodation

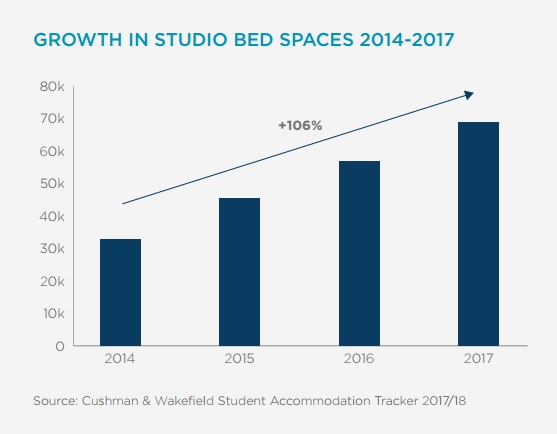

Commercial student accommodation is set to be a growth area, with or without a Brexit deal. Research from Cushman & Wakefield showed that the supply of studio rooms has more than doubled since 2014. In 2017 a record-breaking 30,000 bed spaces were provided.

However, supply is still not keeping pace with the growth of students in recent years. CBRE’s research shows that there still is much headroom for further provision of student accommodation in many cities in the UK.

CBRE’s valuation index of 65,000 bed spaces reached double-digits, with total returns at 11.9% in the 12 months to Sept 2017. This significantly outperformed the Investment Property Database (IPD) All Property Index at 9.5%, which provides an indication of investment performance for the entire real estate market as a whole.

Nett rental growth of the index reached 4.1%, which was pushing double the IPD ERV (Estimated Rental Value) growth, at 2.2%.

Future demand for student property is likely to increase as latest UCAS figures show that student applications have gone up. The number of applications by EU and international students for university places in the UK increased to over 100,000 for the first time in 2018, a rise of almost 8% compared to last year. From this it can be seen that Brexit is irrelevant to students looking to further their studies, and the UK remains a popular place due to the reputation it has for quality tertiary education.

David Feeney, advisory associate at Cushman & Wakefield explains, “The UK is still a global education hub, attracting the best students from around the world. Even with Britain’s exit from the EU progressing, the relatively weak pound has attracted additional applications from non-EU students, with their numbers rising 5% over the last year. It is a key market, as 23% of the UK student population is now from overseas.”

Healthcare

Healthcare real estate investment hit record prices in 2017, reaching double (£1.4bn) that of the whole of 2016 (£720m) in just January to October. A majority of investments went into commercial care homes, far surpassing the rest of the healthcare sector.

The large disparity of care home supply and demand has driven investments in this area. The UK’s population is ageing rapidly and existing facilities are already unable to cater to the current demand. There is also a lack of support for sufferers of dementia, a demographic which is also increasing rapidly.

We can see more real estate investment trusts (REITs) starting to focus on this in 2018 and beyond. AXA’s acquisition of Retirement Villages and L&G’s acquisition of Inspired Villages and Renaissance Villages were all purchases involving established operators with development pipelines.

Conclusion

The current uncertainty in the air continues to dampen confidence and growth in the UK’s economy. Currency-induced inflation has not yet fully dissipated, slowing consumer spending. Yet, as we have said previously, the weak pound has attracted a good number of international real estate investors to the UK, increasing demand for property. The weak sterling provides investors with a great opportunity to get into the UK property market right now, and cash in later when the market regains its footing.

Certain sectors like commercial student property and commercial elderly care homes are Brexit-proof due to the high demand and low supply, regardless of whether the UK does or does not exit the EU with a deal. These sectors also have the advantage of being accessible to the individual investor and not just REITs, with their availability to be purchased in affordable units.

Article by Ian Choong

- http://fortune.com/2018/04/16/patrick-stewart-brexit-second-peoples-vote/

- http://www.irishnews.com/news/worldnews/2018/04/16/news/boris-johnson-draw-upon-star-trek-catch-phrase-to-defend-brexit-1305065/

- https://www.ft.com/content/d0e520be-cf6b-11e7-b781-794ce08b24dc

- http://valuedinsights.cbre.co.uk/uk-student-accommodation-storylines-applications-affordability-and-appetite-from-investors/

- CBRE Brexit Guide for Real Estate Decision Makers

- https://csiprop.com/brexit-uk-property-outlook/

- https://csiprop.com/international-applications-to-uk-universities-hit-record-high/

- https://csiprop.com/press-release-silver-lining-behind-brexit-for-malaysian-investors/

- Feature image: offshorelivingletter.com

CSI Prop proudly promotes international investment property with high yields at low risk. Our portfolio comprises residential and purpose-built student property in cities across the United Kingdom (London, Luton, Manchester, Liverpool, Newcastle, York, Glasgow, Scotland; Sheffield, etc); Australia (Melbourne, Perth, Brisbane) and Thailand (Bangkok). Our projects are concentrated in high-growth areas with great educational, infrastructural and job growth potentials. We aspire to make a difference in the lives of our clients by helping them achieve their investment goals through strong market research backed by third party experts.

Disclaimer: CSI Prop does not provide tax & legal advice and accepts no liability. Readers are encouraged to consult a qualified tax or legal advisor for a thorough review.

Need advice or clarification? Call us for more information and/or to find out about our projects! Hotline: 03-2162 2260