CRYPTOCURRENCY: BANE OR BOON? Despite being declared legal tender in many countries across the globe, cryptocurrency continues to draw an equal measure of flak and fealty.

BREAKING NEWS: Yesterday, Bithumb, a South Korea-based cryptocurrency exchange announced the suspension of its deposit and withdrawal services after $35m worth of cryptocurrencies were stolen by hackers.

Bithumb is one of the busiest exchanges for virtual coins in the world and the second local exchange targeted by hackers in just over a week. The news sent ripples through the market with Bitcoin and Ethereum recording price falls, according to CoinDesk, a news site specialising in digital currencies.

Cryptocurrency: A Precarious Medium

This is not the first nosedive in the cryptocurrency world. Digital currencies — like the stock market — are highly reactive, recording multiple tumbles in recent history.

The price of Bitcoin, the world’s best known digital currency, has been tracking a downward spiral since the start of 2018, plummeting heavily from the Dec 2017 price of $18,960 to $6,762 at time of publication.

Still, cryptocurrency has risen from obscurity and is now legal tender in many countries across the globe. And, it continues to draw flak and fealty in equal measure.

Good:

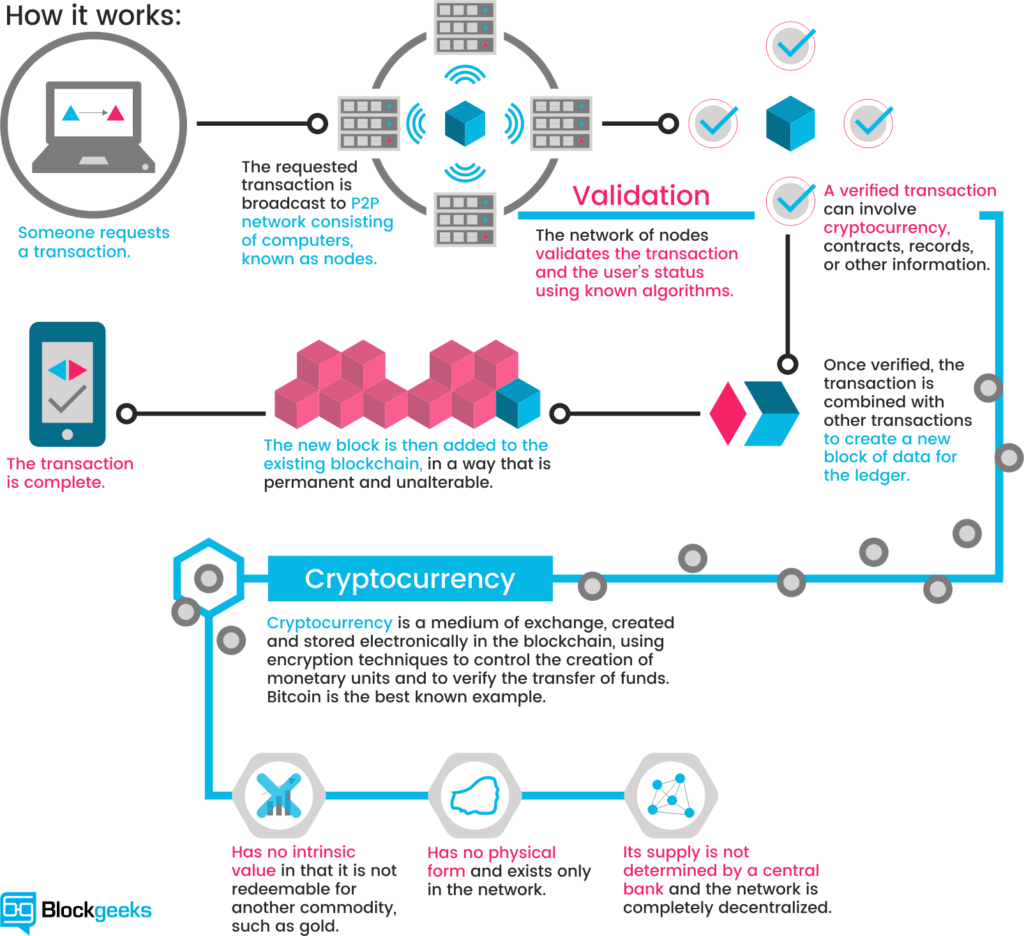

The inherent nature of cryptocurrency and the world of blockchain ensures no possibility of double-spend as the system is built to be irreversible and transparent to the peers within its ecosystem. Cryptocurrency has also been touted as the hottest investment opportunity currently available. The potential rewards (and risks) are huge; its value can fluctuate by as much as a few hundred dollars in a single day and, potentially, one can either make (or lose) a lot of money in a short period of time. One can also trade in it, purchase goods with it, earn money from it (through mining), and it is recognised as a form of payment in some jurisdictions.

Bad:

Cryptocurrencies are high-risk investments and, as such, their market value is highly volatile, fluctuating like no other asset’s. It’s easy to lose (or make) a tremendous amount of money in a day. Cryptocurrencies are not backed by a central bank/organisation, and are therefore unregulated to a certain extent. It is subject to price manipulation. Its security is questionable, as clearly demonstrated in yesterday’s Bithumb heist, as well as incidences of hacking in the past. Perhaps the biggest theft in the short history of cryptocurrency happened in 2014, when more than $450m in bitcoins disappeared from customers’ accounts in the Mt Gox exchange in Tokyo.

Rat Poison Squared

This year, Google, Facebook and Twitter announced a crackdown on cryptocurrency ads on their sites in a move to protect investors from fraud.

Bank of England Governor Mike Carney has been highly critical of cryptocurrency while Bill Gates has gone on record about betting against cryptocurrency, describing it as a “kind of pure ‘greater fool theory’ type of investment.”

More famously, Warren Buffet, in yet another rail against digital currency, described Bitcoin as “rat poison squared” and that it’s “creating nothing”.

“When you’re buying non-productive assets, all you’re counting on is the next person is going to pay you more because they’re even more excited about another next person coming along,” Buffet said in an interview with CNBC.

BitMex CEO Arthur Hayes, however, is unfazed by Bitcoin’s volatility, predicting that the cryptocurrency will hit $50,000 by the end of the year.

Cryptocurrency may well be the investment of the decade with incredible returns, agrees Virata Thaivasigamony of CSI Prop, a property investment consultancy with offices in Kuala Lumpur and Singapore.

“But it needs to approached with a combination of care and sheer ballsiness,” he adds.

“Investment is a very personal matter. For me, cryptocurrency pales in comparison with something tangible like property investment. Real estate has more stability, proving time and again to be a hedge against inflation and a great asset for diversification. Investing in real estate traditionally outperforms most asset classes in risk-adjusted returns. When compared to bitcoin, it is unequivocally the safer investment.”

As inflation rises, so, too, do rents and housing values. In an inflationary environment, real estate assets react proportionally to inflation. And real estate has incredible tax benefits and cash flow incentives.

Ultimately, investing in cryptocurrency — as with all other investments — is a gamble. A question to ask yourself before embarking on any investment is: how risk-averse are you?

We are colossal fans of property investment (duh!) and we make no apologies for it. Still, we remain curious about the many other types of investments out there and would love to hear your thoughts in the comment box below. If you’re a die-hard property investment fan like us, and are thinking of expanding your UK and Australia property portfolio, hit us up: we’ve got some good stuff for you.

By Vivienne Pal

Sources:

- http://www.scmp.com/week-asia/business/article/2131758/us1-billion-down-why-japan-still-love-bitcoin

- https://www.theguardian.com/business/2018/jun/20/south-korea-bithumb-loses-315m-in-cryptocurrency-heist

- https://www.cnbc.com/2018/06/19/south-korea-crypto-exchange-bithumb-says-it-was-hacked-coins-stolen.html

- https://www.cnbc.com/2018/03/26/bitcoin-falls-7-percent-to-below-8000-after-twitter-bans-cryptocurrency-ads.html

- https://www.express.co.uk/finance/city/960363/Bitcoin-cryptocurrency-free-fall-price-value-plummets-24-hours-6-price-drop-money-finance

- https://cryptoslate.com/cryptocurrency-exchanges-are-charging-more-than-nasdaq-for-listings-faking-volumes/

- http://fortune.com/2018/01/10/bitcoin-warren-buffett-cryptocurrency/

- http://fortune.com/2018/05/07/warren-buffett-bitcoin-rat-poison/

- https://blockgeeks.com/guides/what-is-cryptocurrency/

- https://cointelegraph.com/bitcoin-for-beginners/what-are-cryptocurrencies#buy-goods

- https://csiprop.com/uk-property-outlook-2018/

- https://csiprop.com/australia-property-outlook-2018/